Brice Wallace

The outgoing chair of BioUtah has a succinct description for Utah’s life sciences industry: “cranking on all cylinders.”

With those words to kick off the recent BioHive Summit in Salt Lake City, Brad Brown was just the first of several speakers with glowing words for the industry, with another saying it is “ready to pop.”{mprestriction ids="1,3"}

“In many ways, our life sciences industry has moved to a new phase of maturity and visibility,” Brown told the crowd. “It exhibits itself in the expansion that you see now,” including in growth of BioUtah’s membership.

“In terms of expansion, we’re cranking on all cylinders. We’ve been known for the sizeable medical device manufacturing in Utah. That’s still the case. Utah is ranked eighth nationally for the production of medical devices. That’s impressive. We also have a very diverse industry, with a significant footprint in diagnostics and a growing biotech and biopharma presence.”

In fact, a recent assessment indicates that Utah is one of only three states with a high employment concentration in three life sciences segments: medical devices, laboratories and pharmaceuticals.

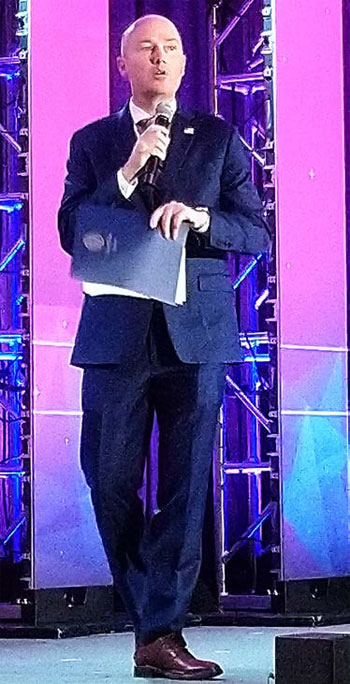

Gov. Spencer Cox noted that about 1.9 percent of Utah’s total employment is in the life sciences industry.

“Now, 1.9 percent may not seem like a lot, but let me assure you that it is,” he said. “In fact, if you take the average of the top 20 states for life sciences, their average is 0.9 percent.”

In various rankings, the Salt Lake City metro area is second for the concentration of medical device employment, Utah is in the top 10 in the medical devices space, and Utah is eighth in venture capital investments per capita the past two years.

A study by the Kem C. Gardner Policy Institute at the University of Utah showed that employment in Utah in the year 2020 slipped 1.8 percent. However, life sciences employment grew 7.2 percent, far outpacing national life sciences job growth of 0.5 percent.

Utah’s life sciences industry accounts for 59,000 direct jobs and 160,000 direct and indirect jobs. It also contributes over $13 billion in GDP.

“So, while only 1.9 percent of employment, over $13 billion in GDP,” Cox said. “That’s more than our tourism industry, which is one of the largest, of course, in the United States.”

The governor added that life sciences, like most other industries in Utah, is struggling to find enough workers. To keep the industry growing, he urged life sciences companies to help the state and others in preparing the next generation for jobs in STEM fields.

“We have amazing institutions of higher learning in the state. We have amazing technical colleges in the state. There are so many opportunities now for our young people to learn more about STEM careers, to be prepared for those STEM careers. But we can’t do it alone,” Cox said.

The governor said Utah’s economy is strong despite certain headwinds. “We are better because of you,” he told the crowd. “We want more of you. We want to help you be successful. Please let us know how we can help.”

Kelvyn Cullimore, BioUtah president, assured the governor that life sciences is “very recession-resistant. People still need the kinds of things we do.”

In a breakout panel at the event, Dan Hemmert, executive director of the Governor’s Office of Economic Opportunity, said state officials are working on ideas to help the life sciences industry. “When we look at Utah … one place where we’re not great, never have been great, is using state dollars to incentivize commercialization,” he said.

Still, life sciences has helped Utah become the No. 1 state for new innovation jobs per capita and the state with the highest probability of a startup company becoming a “unicorn.” he said.

A pioneering spirit and a cultural environment have contributed to produce strength in Utah’s technology, aerospace and defense, and financial services sectors, he said. “The next one we see that’s just right there, primed and ready to pop,” Hemmert said, “is life sciences.”{/mprestriction}