Brice Wallace

The lingering effects of the COVID pandemic, inflation, supply issues, a tight labor market and the Russian-Ukraine conflict are combining to provide a potent blend of bad for Utah’s small businesses.

Nonetheless, 45 percent plan to hire employees over the next six months.

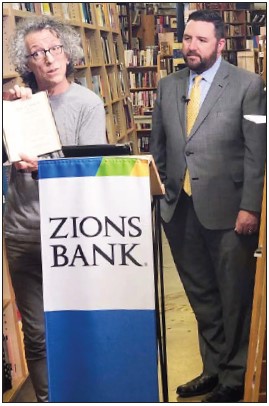

“Two years into the pandemic, the outlook for Utah’s small businesses are mixed,” is how Robert Spendlove, Zions Bank’s economist, assessed the current state of affairs.{mprestriction ids="1,3"}

Speaking at a news briefing on National Mom and Pop Business Owners Day, Spendlove said concerns about inflation “continue to dominate consumer minds.” Year-over-year inflation has hit 7.9 percent nationally, while the figure in Utah is 9.7 percent.

“The Russian war with Ukraine is adding more uncertainty to the economy just as we’re turning the corner on the COVID pandemic,” he said.

The conflict has pushed oil prices to a new highs and disrupted the wheat supply, which will put pressure food prices, and nickel, an ingredient in stainless steel and lithium-ion batteries. “This will add yet another element of uncertainty to the small-business recovery,” he said.

That recovery is taking some time. Spendlove quoted Census Bureau statistics that indicate that 47 percent of Utah small businesses say they are operating at normal levels, while 29 percent say their recovery will take more than six months. Three-fourths of Utah’s small businesses report a moderate or large increase in costs. Half are experiencing supplier, production or shipping delays, and 30 percent are having difficulty hiring employees.

Small businesses account for 99 percent of the state’s companies and employ 45 percent of the state’s workforce.

But some relief may be ahead. The Federal Reserve is “taking aggressive action to control prices,” raising a key short-term interest rate in March, the first hike in three years. And up to six more are expected in the next year, perhaps resulting in a rate increase of up to 2 percent. The Fed’s goal, Spendlove said, “is to deflate some of the bubbles that have formed because of the overheating economy.”

And Utah has seen job gains in all 11 major industry groups over the past year, and the new employees expected at 45 percent of the small businesses “will drive additional growth.” The state added 66,000 jobs over the past year, pushing total state employment up 4.2 percent.

Among the small businesses that have weathered the storms is 93-year-old Weller Book Works at Trolley Square in Salt Lake City.

“I’d say we came through the pandemic pretty well,” said owner Tony Weller. “We had a 5 1/2 month furlough of staff with doing some mail orders from within, [we] opened up carefully and our post-pandemic business has been pretty good. I think people missed going into physical environments.”

The bookstore has seen customer preferences swing since the pandemic hit. Early on, it sold lots of books about baking, gardening and raising chickens, Weller said. During the Black Lives Matter period, there was a huge surge of interest in African American cultural books and political books. During the entire pandemic, customers were interested in books about philosophy, religion, psychology and poetry. “I think people were looking for emotional footing at an insecure time, and they were reaching towards books to try to find that footing,” Weller said.

In the post-pandemic period, the store has “felt a lot of generosity from local citizens,” Weller said. “When the doors were opened again, many of them expressed their concern for our survival. …”

Both Spendlove and Weller pushed the idea of shopping at local small businesses. Spendlove said 67 percent of money spent there stays in the community. Weller estimated the amount to be only slightly smaller.

“What’s clear is nobody says it’s of equal value,” Weller said. “Everyone who measures shows that when a local business collects the money, more money stays in the community,” with more tax dollars generated and more local professionals hired being among the benefits.{/mprestriction}