By Marla Trollan

With National Small Business Week in the rear-view mirror, I am encouraged by the outlook for Utah’s economy. As large reports are coming in after the pandemic, Utah has stayed in the spotlight and continues to get recognized as one of the strongest economies in the country and one of the best places to do business. In fact, Utah has held the No. 1 spot for the Best Economic Outlook on Rich States, Poor States list for 14continuous years, and the Fox Business list since 2012.

Utah has an impressive amount of collaboration among businesses and economic development organizations. We work together to find innovative solutions and create economic initiatives to help businesses thrive. These collective efforts, along with the efforts of our amazing business owners, have garnered considerable recognition for Utah in national rankings:

• No. 1 Best State Economy, WalletHub, June 2021.

• No. 3 Top State for Business, CNBC, July 2021.

• Best Economy, U.S. News and World Report, March 2021.

• No. 1 Best State for Entrepreneurs, Forbes, November 2019.

• No. 2 Best Place in America to Start a Business, Inc. magazine, August 2019.

• No. 3 Best State for Business, Forbes, December 2019 (No. 1 six times in the past decade).

Although Utah has become accustomed to phenomenal economic success, no one was immune to the difficulties brought on by the COVID pandemic. Nearly all industry sectors have been negatively impacted, with many of our tourism-based rural communities seeing disproportionate losses. The SBA Utah District Office worked hard to ensure that COVID-relief assistance, legislated and funded by Congress, was available to all Utah small businesses. It was important to our SBA team to make sure that information and resources were available throughout the state so all eligible businesses would know about and could have access to this support, including even the smallest of small businesses.

The most popular SBA COVID assistance program for small businesses was the Paycheck Protection Program (PPP). The PPP was designed to help small businesses keep their employees on the payroll while they weathered health-mandated closures and worked to adjust their business models for the new reality. The PPP was originally created under the Coronavirus Aid, Relief and Economic Security Act (CARES Act) with $349 billion in funding. The program was so popular that the funding was exhausted in two weeks. The program got an additional $310 billion under the Health Care Enhancement Act (HCEA), $284.45 billion under the Economic Aid to Hard-Hit Small Businesses Act and $7.25 billion under the American Rescue Plan Act (ARPA).

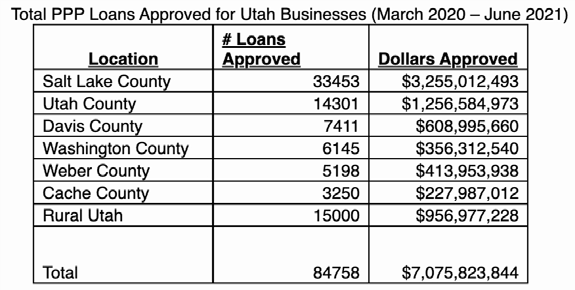

Through the PPP program, SBA aided small businesses across the country with almost 12 million loans totaling close to $800 billion. SBA’s Utah District Office, along with over 500 participating lenders, approved 84,758 PPP loans amounting to $7,075,823,844 for small businesses here in the state. Of that amount, about 15,000 loans for almost $1 billion went to businesses in rural Utah.

Figure 1

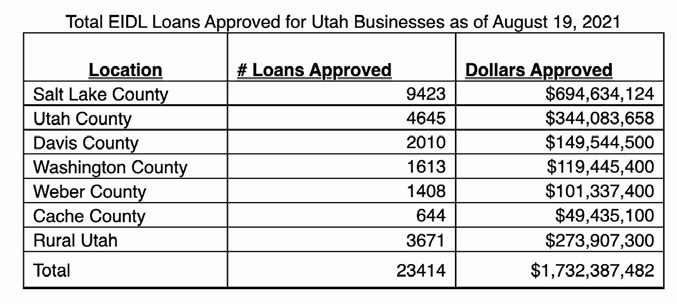

While the PPP was essential for our businesses to combat the threats and setbacks of the pandemic, other SBA assistance was also available. Once the pandemic was declared a national disaster in March 2020, businesses that could demonstrate actual or anticipated economic impact from the pandemic were eligible for SBA’s long-standing Economic Injury Disaster Loan (EIDL) program. The CARES Act added $10 billion to the EIDL program which, like the PPP program, quickly ran out of funds. An additional $50 billion was put into the program by the HCEA. In 2021 another $15 billion was added to the program with the ARPA legislation. Utah businesses received 23,414 loans for $1,732,387,482. Utah businesses in low-income communities were also eligible to receive supplemental advances under the EIDL program.

Figure 2

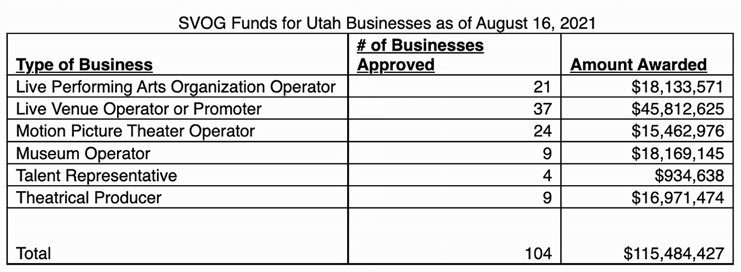

In addition to the PPP and EIDL programs, Congress created a couple of SBA programs targeted towards specific industries that were especially hard hit by the pandemic. The first program, the Shuttered Venue Operators Grant (SVOG), passed in the HCEA, provided SBA with $15 billion to award grants to live venue operators, theatrical producers, live performing arts organizations, museums, movie theaters and talent representatives. An additional $1.25 billion was appropriated under the ARCA. As of Aug. 2, the SBA has been able to provide funding through the SVOG to 104 Utah businesses amounting to $115,484,427.

Figure 3

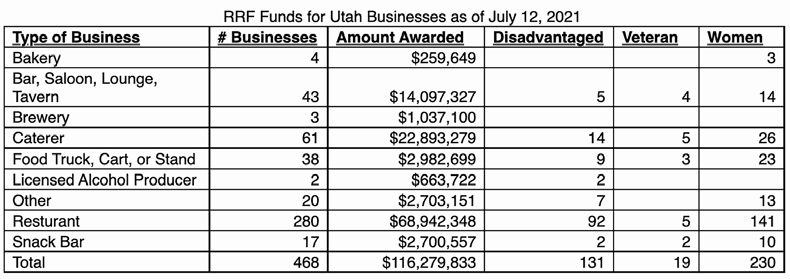

The second program is the Restaurant Revitalization Fund (RRF), passed as part of the ARPA. The RRF was funded with $28.5 billion and allowed SBA to provide targeted support to restaurants, food trucks, caterers, bakers, bars and others in the food and beverage industries. Of this appropriated amount, over $116 million went to 468 Utah businesses — 41 to rural county businesses, 230 to women-owned businesses, 131 to socially and economically disadvantaged businesses and 19 to veteran-owned businesses.

Figure 4

All-in-all, SBA’s COVID-relief programs provided over $9 billion in support to Utah small businesses when it was desperately needed. I have heard from many of these small businesses that they would not have survived without the help. I had the opportunity to visit some of these businesses over the past year. I have been impressed by the resiliency and creativity of these businesses as they have adapted to address a changing environment. For example, restaurants developed online applications for easier ordering, added curbside pickup, increasingly utilized delivery services and incorporated drive-through windows.

We are still in a critical time for our small businesses and need to continue to work together to help these small businesses recover from the hardships caused by the pandemic. It’s important to remember that, although there is much work to be done, this is not a rebuilding but a continuation of communities working together to repair damages from an external event.

A couple of years ago, our state’s businesses and economy were stronger than ever, and we expect a successful rebound from the pandemic’s setbacks. Our SBA Utah District Office is dedicated to continuing to work with our partners to assist small businesses in healing and returning to prosperity.

Marla Trollan is the SBA’s Utah District director in Salt Lake City.