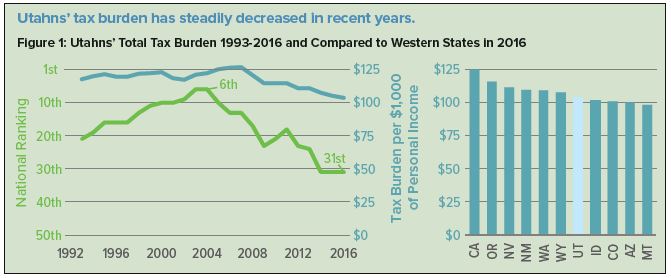

The tax burden on the average Utahn in 2016 was the lowest in 25 years, according to a Utah Foundation report released last week. “A Lighter Load: Utah’s Changing Tax Burden” looks at data over a 24-year span from 1993 to 2016, the latest year for which full data is available.

The report calculates Utah’s tax burden as a ratio of governmental revenue per $1,000 of personal income (the proportion of Utahns’ earnings that are used to fund local and state governmental services).{mprestriction ids="1,3"} It finds that Utah’s tax burden has seen a strong decline since 2007. While the property tax burden has remained fairly steady, the burden of all other taxes and fees has decreased sharply, leaving Utahns with a higher share of their income.

In 2003 and 2004, Utah had the sixth-highest tax burden in the nation, the report found. By 2016, it had fallen to 31st. Utah’s falling sales tax burden was responsible for one-third of the total decline from 2007 to 2016.

The findings determined that a primary factor in Utah’s falling tax burden is rising personal income. Utahns’ total personal income increased by 51 percent between 2007 and 2016, the third-fastest increase in the nation. About one-third of the growth in personal income is from population growth, while two-thirds is from growth in per capita personal income. However, inflation accounts for about half of the increase in per capita income.

Utah’s property tax burden is the only component to have increased from 2007 to 2016.

Utah’s motor fuel tax burden has eroded since 1998 due to inflation and improved fuel efficiency, the data showed. During the past decade, Utah saw one of the nation’s largest drops in fuel tax burden.

Utah Foundation President Peter Reichard said the driving force behind the declining burden is good news for Utahns’ finances. “Personal income is rising and citizens are keeping more of what they earn,” Reichard said. “However, population growth is also a driver and maintaining public services and infrastructure in the face of that growth can be a fiscal challenge.”

The full report is available on the Utah Foundation website at www.utahfoundation.org.{/mprestriction}